Discount real estate broker breakdown

Low rates are the main focus of discount real estate brokers. Many discount brokers offer a built-in commission savings of 20-30% when listing with a traditional brokerage or realtor.

You will need to learn how real estate commissions work to understand how they can save you money.

One study found that the median income for an real estate agent in the United States is $42,246, with the highest-earning agents earning up to $64,198. This income comes primarily from commission fees.

The seller pays the commission fee in a traditional real estate transaction. Or, more precisely, it is taken from the seller’s proceeds at closing.

The average commission rate of 5.45% is made up of two separate fees per agent involved in the sale.

- The listing agent receives the fee to market the property and helps it sell.

- For bringing their client to buy the home, the buyer’s agent’s fee is paid to them.

The commission is usually split between the two agents. In this case, each agent would make approximately 2.7%.

Traditional commission breakdown

| Fee | Rate |

| Listing fee | 2.7% |

| Agent fee for the buyer | 2.7% |

| Total commission | 5.45% |

Discount brokers often offer discounts on the listing fees side of the equation. For example, a discount broker might charge a 1% listing fee instead of the 2.5-3% standard, which would lower the total commission to approximately 3.7%.

Discount commission breakdown

| Fee | Rate |

| Reduced listing fee | 1% |

| Agent fee for the buyer | 2.7% |

| Total commission | 3.7% |

Notice: Buyer’s agent fees are around 2.5-3 percent

Discount brokerages, and traditional agents, for that matter, will advise you to pay the full buyer’s agent fees. The rates vary depending on the market but are generally 2.5-3 percent nationwide.

Why is it so essential to offer a full buyer agent commission? It encourages other agents to sell your home to clients. This is your best chance to find a qualified buyer quickly and get the best price for your home.

How can discount brokers in real estate charge lower fees

Discount brokerages often have pricing and service models that provide real value to their customers.

An example is a company that saves money by solving big problems for traditional agents and generates steady business volume.

Even the most successful realtors can spend a lot of money marketing. This allows them to meet new clients with no upfront costs. They can charge a fraction of the typical commission fee to your agent and pass these savings onto you.

These discount brokers need to be more efficient than traditional brokerages to offer lower rates and remain profitable. Each company approaches this differently, but the majority of them use some combination of these:

- Attracting new customers with less-expensive initiatives

- A smaller team handling a greater volume of customers.

- Upsell existing customers to other in-house services (loan title, insurance).

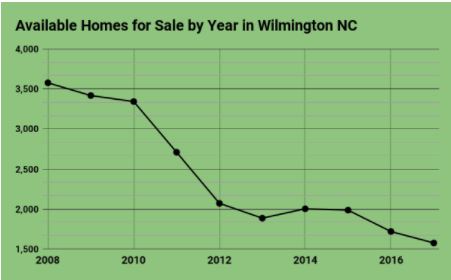

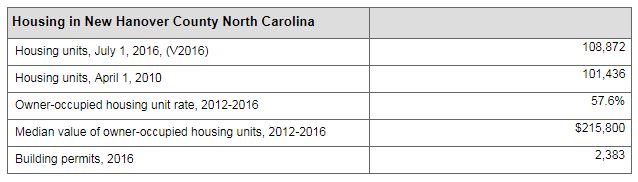

It’s not surprising that some strategies are more successful than others. Understanding the business model and the risks involved in discount brokerage is important. Check out these real estate trends to help get a better understanding of how

Five common drawbacks of discount brokerages in real estate

- Hidden fees

- Upfront fees

- Minimum fees

- Cancellation fees

- Commission for the Buyer’s Agent

If you are considering hiring a discount brokerage or agent for real estate, shop around and compare several options to ensure you get the best value for your needs.

The bottom line: Should you use discount brokers?

A discount broker is a good option for most home sellers. Brands like Change Realty provide great customer service and big savings. We recommend discount brokers because they offer a similar experience as working with traditional realtors. This makes them an excellent choice for most people.

Nevertheless, there are some discount brands that you should not consider. Companies that offer fewer services and less support than traditional realtors should be avoided. Although these “limited-service” brands may advertise low rates, you will be faced with risky service compromises that could limit your savings.